35+ Investment property refinance rates

First rate lock is free then 35 for each additional. Closing a refinance takes about 35 to 45 days on average.

Your Adjustable Rate Mortgage Needs To Be Refinanced

Variable Rate Home Loan.

. Investing in property is often seen as the less risky form of investment unlike stocks or managed funds that can require specialised knowledge to get a foot in the door. 3030 whereas the term of a commercial loan is usually shorter than the amortization ie. Over the past year multifamily cap rates in all asset classes fell by an average of 54 bps which on a million-dollar purchase equals an.

Cash-out refinance to buy investment property or a second home. Shop cash-out refinance rates today. Investment Checking Rates.

725 causing the borrower to have to refinance or payoff the loan or sell the. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. The rules differ for investment property which is typically depreciated.

To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address. Louis County for example the average effective tax. Rates exclude Condominiums Investment Properties and HARP Loans.

Rates Effective September 2 2022. The states average effective property tax rate is 093 somewhat lower than the national average of 107. All VA loans are subject to a funding fee of up to 36 of the loan amount.

Term Fixed Rate Floating Rate Max. Compare the top interest rates and offers to save on your mortgage this September. It can be used for both either the acquisition or refinance of an investment property.

Minimum fixed rate loan amount of 5000 applies. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. 80 More details.

Property insurance and if applicable flood insurance is required. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. Down Payments for Investment Property Loans.

22 percent 24 percent 32 percent 35 percent and 37 percent. A strategic approach to choosing an investment property in Melbourne. About Multifamily Apartment Cap Rates Today.

The Encyclopedia of Commercial Real Estate Advice Member of the Forbes Real Estate Council. 15 Year Fixed Refinance. Todays apartment interest rates range from -009 and 1614.

By Terry PainterMortgage Banker Author of. Time to refinance your investment property loan. Express Home Refinance Rates.

Rates Effective September 2 2022. If you dont plan to live in your investment property expect to put down 15-25 on an investment property loan. Here are some of the factors to look for when selecting an investment-grade property.

The amount of new loans to refinance a home was expected to drop to 430 billion down 283 percent from 2017 while the amount of new mortgages to buy a home will likely increase by 73 percent to 12 trillion MBA said. We researched and reviewed the best investment property loans based on rates terms and more. Also known as owner-occupier loans include but are not limited to loans to fund the purchase of a property or refinance an existing loan where the borrower currently.

Fourth Quarter 2021 Cap Rates. Whats the difference between a property to live in and an investment purpose. TYPE AND TERM.

5 7 and 10 Year terms are capped at 895 APR 15 and 20 Year terms are capped at 9. 20 Year Fixed Refinance. Cash-out refinance rates.

Fixed 0 363. 30 Year Fixed Refinance. Maximum loan amounts for VA loans are determined by property location.

Often between 20 to 35. As rates are expected to keep rising refinance is expected to make up a smaller share of the overall market. Please note that we can only estimate your property tax based on median property taxes in your area.

The current index for variable rate loans is derived from the 30 day average SOFR index thus changes in the SOFR index may cause your monthly payment to increase. The origination fee may be waived for a 025 increase in the interest rate. How to know when you can afford to buy an investment property.

You will also have more flexibility with terms and rates. Learn more about refinancing your investment loan and how to raise equity in it. Lenders see investment properties as a riskier venture as you are more likely to default on a property you do not live in.

Some restrictions may apply. Possible tax advantages consult your tax advisor. Additionally the term and amortization typically match on a residential loan ie.

Rates in Missouri vary significantly depending on where you live though. Educational Assistance Allowance for trainees under the Survivors and Dependents Educational Assistance Program Chapter 35 of title 38 USC. The following basic monthly rates are effective October 1 2019.

To get the best rates and terms youll want to. We believe that 80 of your propertys performance is related to its location one that outperforms the averages and 20 or so is related to buying the right property in that location. Different rates apply for interest only repayments.

Compare Save Today. Purchasing a property such as a house or unit can be quite profitable - especially if the purchaser takes their time to learn about how to reap. Rates Terms For variable rate loans the current index rate is 229 and may change monthly.

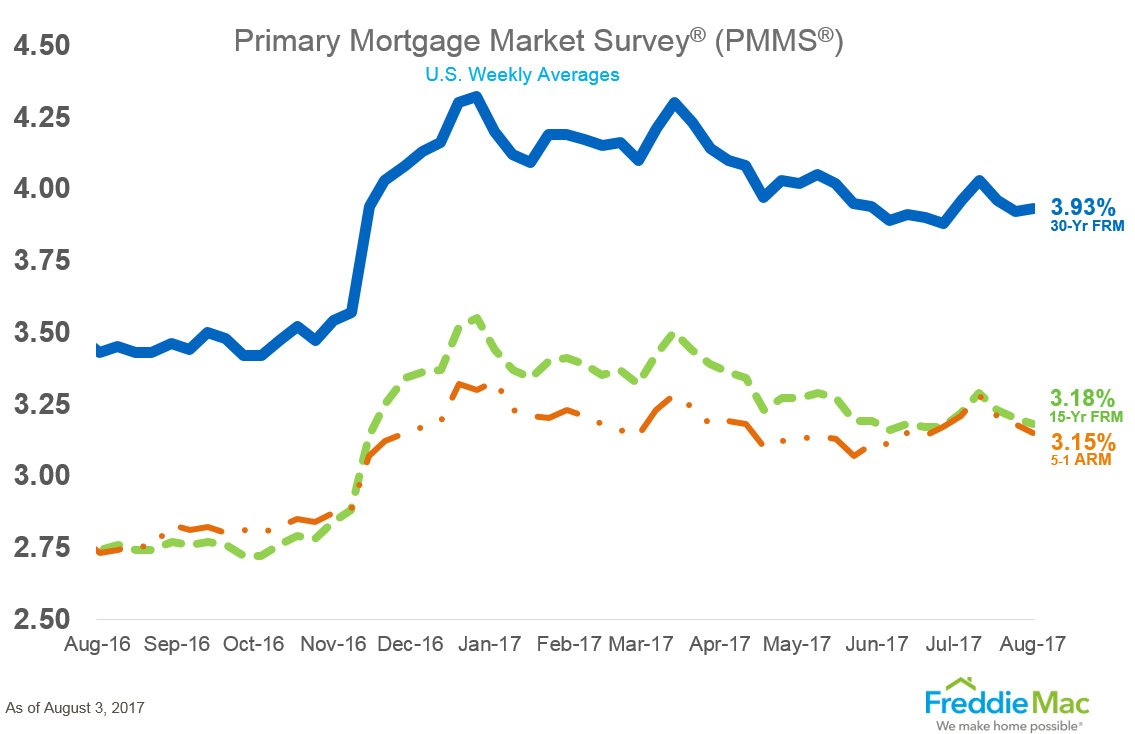

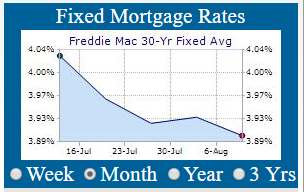

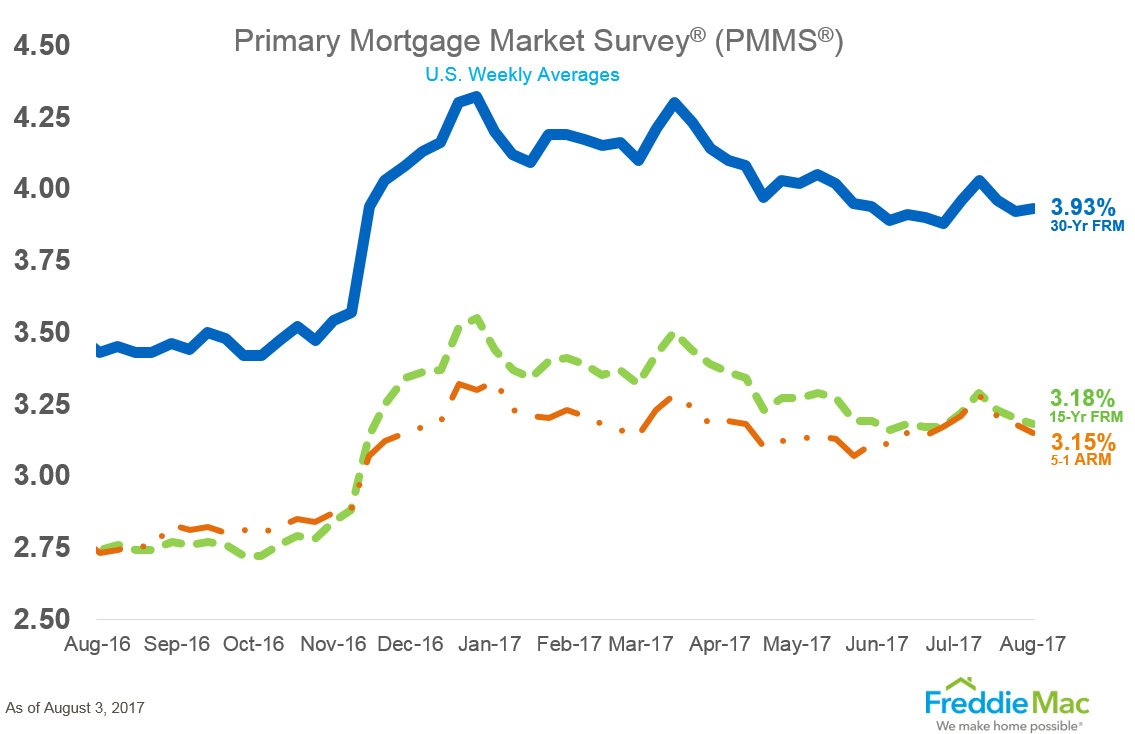

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

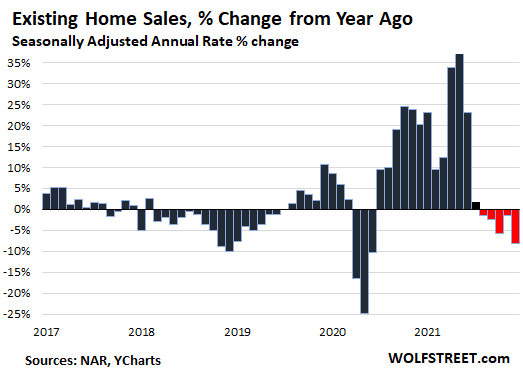

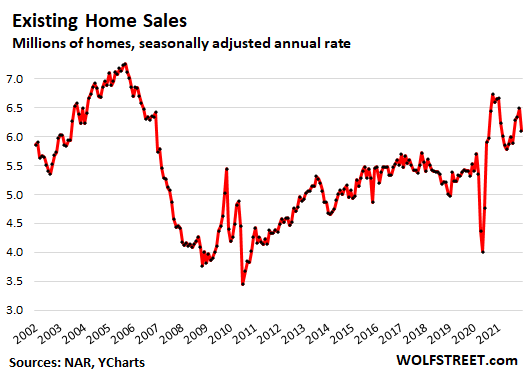

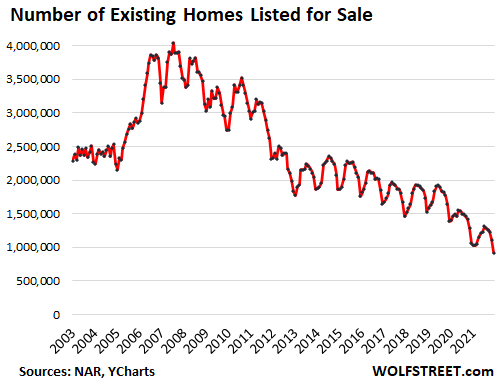

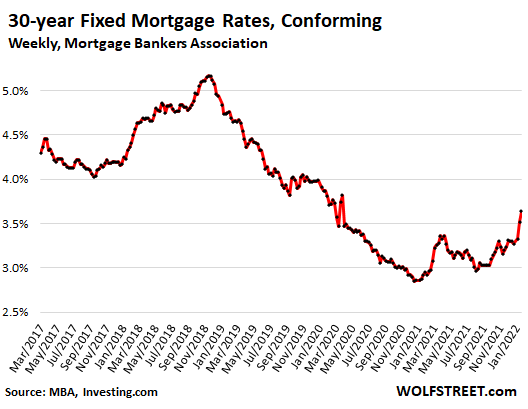

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

Why Are Mortgage Rates Falling After The Fed Raised Interest Rates

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Your Adjustable Rate Mortgage Needs To Be Refinanced

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

Book Review The Brrrr Rental Property Investment Strategy Made Simple Propertyonion

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

Should You Pay Off Your Mortgage If You Could

Ex 99 2

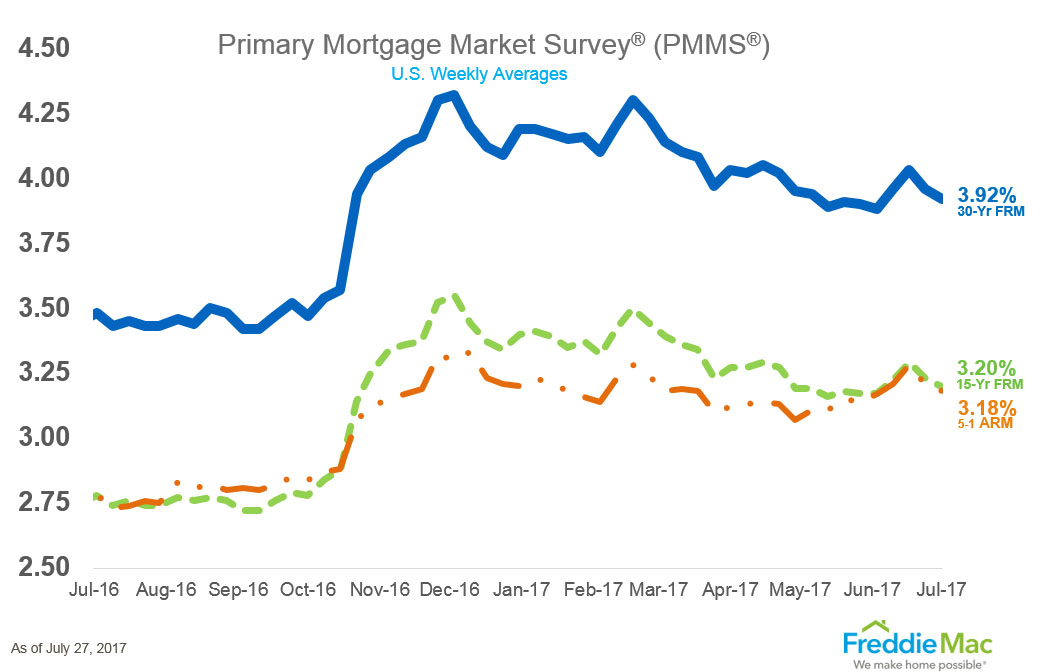

Why Are Mortgage Rates Falling After The Fed Raised Interest Rates

Why Are Mortgage Rates Falling After The Fed Raised Interest Rates

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

Explore Our Sample Of Real Estate Investment Analysis Template Investment Analysis Spreadsheet Template Real Estate Investing

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Why Are Mortgage Rates Falling After The Fed Raised Interest Rates